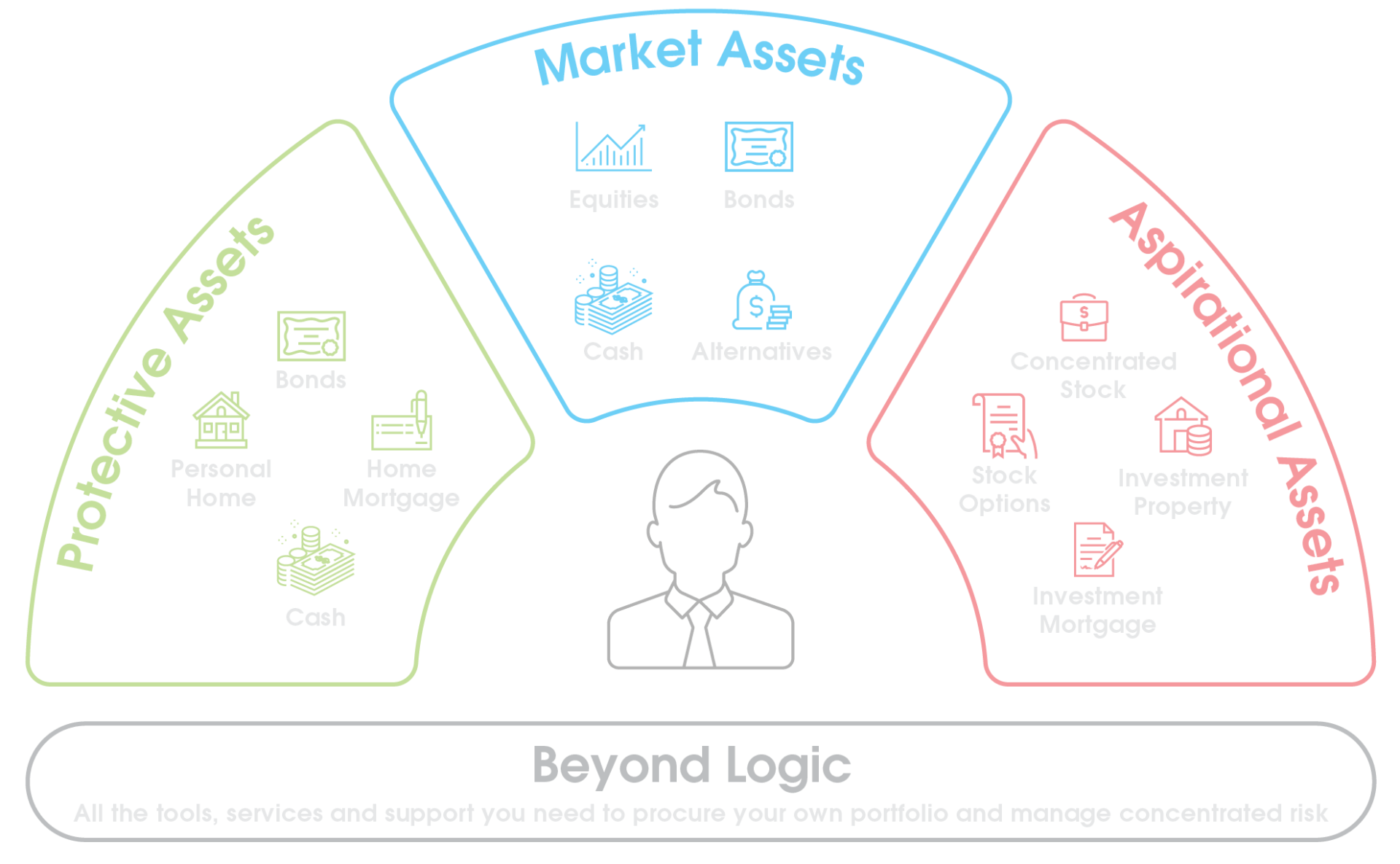

Greater influence for aspirational investors

The pursuit of an aspirational investment goal involves managing concentrated risk and the leverage of non-recourse debt. Until now, investors have been limited by advisors and planners who's focus has been on the exact opposite; diversified portfolios designed to reduce risk.

While this may suit conservative investors, it falls short for investors who have higher expectations.

At Beyond Logic™, we leverage our domain knowledge in decision science to provide investors the tools, processes and expertise they need to procure their own highly concentrated investment programs, while managing risk on their own terms.

Have more influence over your wealth creation

Design and procure your own aspirational investment portfolio

The current advice model has been built on a 70 year old philosophy. While the value of Modern Portfolio Theory cannot be denied for the average investor, the world's most successful investors do things very differently. Rather than diversifying, they have the ability to manage concentrated risk. This does not mean that they disregard risk, to the contrary, it requires that investors have superior insights, control and influence over how investment decisions are made and how money is allocated to projects. Our process helps you create your own opportunities by procuring your own aspirational investment mandate.

Reduce your reliance on intermediaries.

Take control over your own financial future.

Beyond Logic helps investors break from limitations set by advisors and planners, to access exciting investment-grade projects otherwise not available to the general public. Our approach puts investors in the drivers seat in a way that is personal, intuitive and engaging. We help investors attract new opportunities based on their own interests; create deeper insights and transparency for higher levels of accountability; and have more influence over how money is allocated by giving them direct access to decision makers, without the influence of intermediaries.

Carpe Diem. Seize the Day.

Personal

Making sure your best interests are met is not a trivial exercise. Early oversights can easily become long term impairments resulting in average or below average returns.

At Beyond Logic, we address this by giving investors the tools they need to ask better questions and make better decisions. Don’t accept limitations forced upon you by intermediaries; define your needs on your own terms, then procure it.

Portfolios based on your best interests

Intuitive

The choices available to an investor are often constrained by what options advisors and fund managers make available to them. Instead of focusing on what you really want, they often make assumptions based on their own biases, which can influence the preferences of an investor. Most investors are completely unaware of how these decisions impact their long-term outcomes.

At Beyond Logic, we help investors become more engaged in the process. We work backward from your aspirational vision in a way that makes choosing the best portfolio a very straight forward process, to help you establish a portfolio that is meaningful to you.

Deeper insights with more transparency

Engaging

Traditional approaches to portfolio management lack the kind of engagement that makes it really impactful to investors. Most practices only fulfil the minimum requirements as defined by the regulators.

At Beyond Logic, our technologies give investors complete visibility over their investments at all times. The ability to communicate with decision makers directly, allows investors to actively monitor how hard their money is working to meet their financial goals. We make investing a human experience.

Be more engaged with how your money is invested

All the tools you need to make better investment decisions

Evaluating the performance of your investments is not a straightforward exercise; many factors need to be considered. Beyond Logic™ provides aspirational investors the tools and support they need to define their own best interests; create higher levels of accountability by benchmarking risk, fees and performance. Quickly compare fund managers; understand how market events impact performance; and why certain investment decisions are made. This helps you measure how value is created in your portfolio, and what portion of your passive strategies can be allocated to building your own portfolio.

Improve the quality of communications to have greater influence

Investor Technologies Powered By

Your Investor Advocacy Team

Beyond Logic™ was founded on a simple premise: to provide aspirational investors the tools and support they need to make more informed investment decisions. We bring together a highly-specialised team of subject matter experts with expertise in risk management; decision-science; communications; technology and legal to give you everything you need to create the outcome you desire. With evidence-based practice and ethics at the core of our values, our function is to advocate for investors by helping them define their own investment mandates, while providing the tools they need to create higher levels of accountability from fund managers directly.

We're on your side.

Let's start building your Aspirational Portfolio

Personal | Intuitive | Engaging

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

AFSL 300776 | Pinnacle Equities

Privacy Policy | Terms and Conditions

Investor Technologies Powered By

Beyond Logic is an icu2 Innovation Centre Initiative.

© Copyright 2022 - icu2 Pty Ltd - All Rights Reserved